Loan Servicing

Elevate Your Lending with Fusion Loan IQ

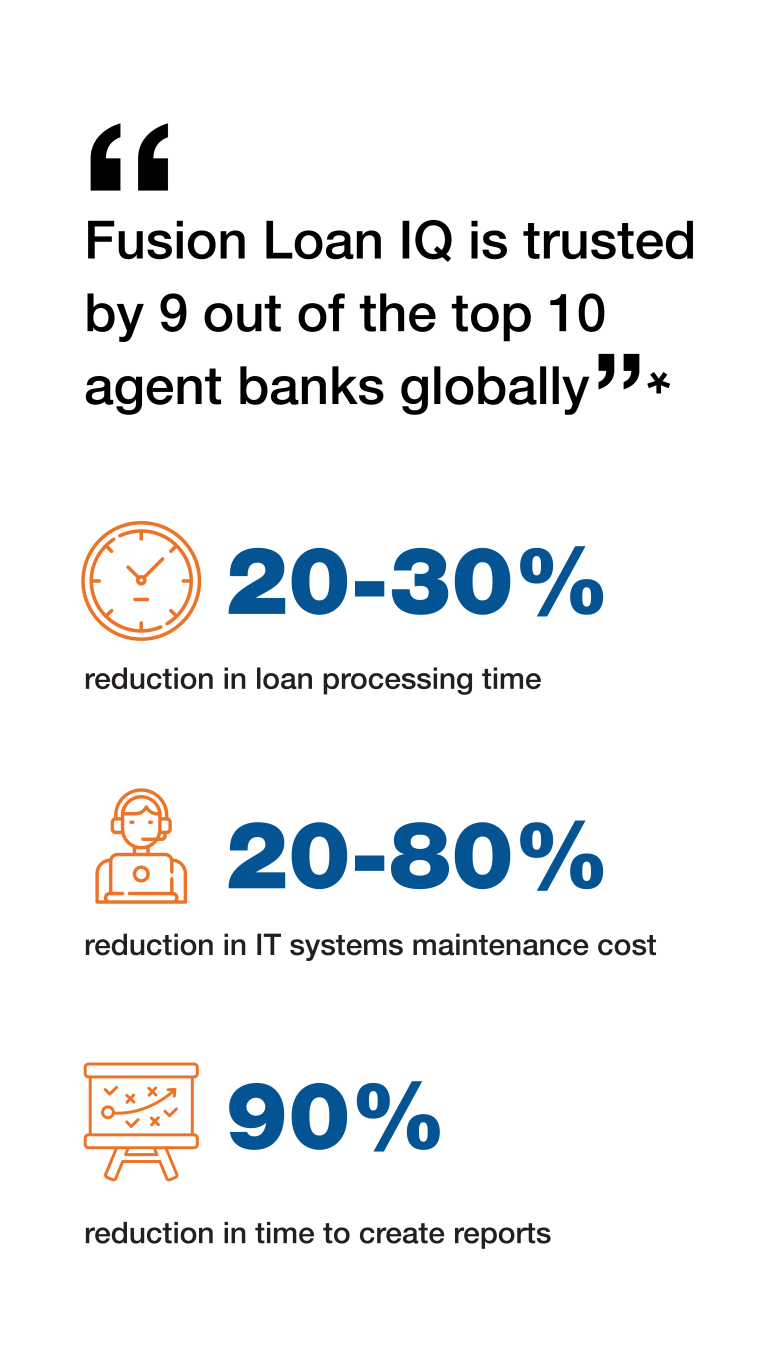

Fusion Loan IQ is the most trusted platform for managing commercial and syndicated loans. Enhance, streamline, and automate corporate lending with Loan IQ

Tackle Industry Challenges with Confidence

Regulatory Compliance Unveiled

Navigate complex regulation compliance (IFRS 9/CECL) with ease. Combat rising costs and risk with advanced, data-driven solutions.

Optimize Operations

Streamline processes to reduce manual errors. Meet the demand for agile, transparent loan services with cutting-edge technology.

High Costs and System Fragmentation

Eliminate costly legacy systems updates and integration problems. Improve data access and enhance customer satisfaction.

Stay Ahead of Client Demands

Adapt swiftly to modern lending trends. Compete with intuitive, flexible solutions from alternative lenders.

Lead the Future of Lending with Excellence

Boosting Efficiency

Automates processes to significantly reduce loan processing and setup times, enhancing productivity.

Streamlined Servicing

Integrates multiple legacy systems into one platform for improved efficiency and portfolio visibility.

Cost Savings

Cuts IT support, integration, and maintenance costs with a scalable, unified platform.

Proven Expertise

Developed through 35 years of industry collaboration.

Enhanced Transparency

Centralize high-quality data for improved decision-making and compliance reporting, reducing loan defaults and report creation time.

Flexibility and Scalability

Adaptable to your specific needs, available as an installed solution or service for rapid deployment.

Why Fusion Loan IQ Is Your Strategic Advantage

Efficient Loan Management

Revolutionize loan booking and processing for all portfolio types, including complex syndicated loans.

Real-Time Accounting

Leverage detailed, real-time accounting with comprehensive audit trails for unmatched accuracy.

Advanced Collateral & Servicing

Seamlessly manage multi-lender deals and complex collateral across the entire loan lifecycle.

“Unlock unparalleled solutions and elevate your lending strategy with Fusion Loan IQ. With FINEXCORE, you’re not just keeping up—you’re leading the way.”

Fusion Loan IQ is the most trusted platform for managing commercial and syndicated loans. Enhance, streamline, and automate corporate lending with Loan IQ

You cannot copy content of this page