Facts about Loan IQ – Did you know?

Loan IQ essentially provides a single data model that aspires to create a global platform. Automation, based on the vital data, helps reduce errors and operational cost. Among the sustainable benefits of a Loan IQ model are seamless functioning of the entire loan lifecycle and greater control over profits.

The new age Loan IQ models are answering a lot of crucial questions posed by the financial industry. Banking systems are starting to rely heavily on Loan IQ models for business optimization, greater transparency and cost efficiency. The changing phenomenon is also facilitating lower process redundancy and inherent risks.

These are few facts that might amaze you, do you know?

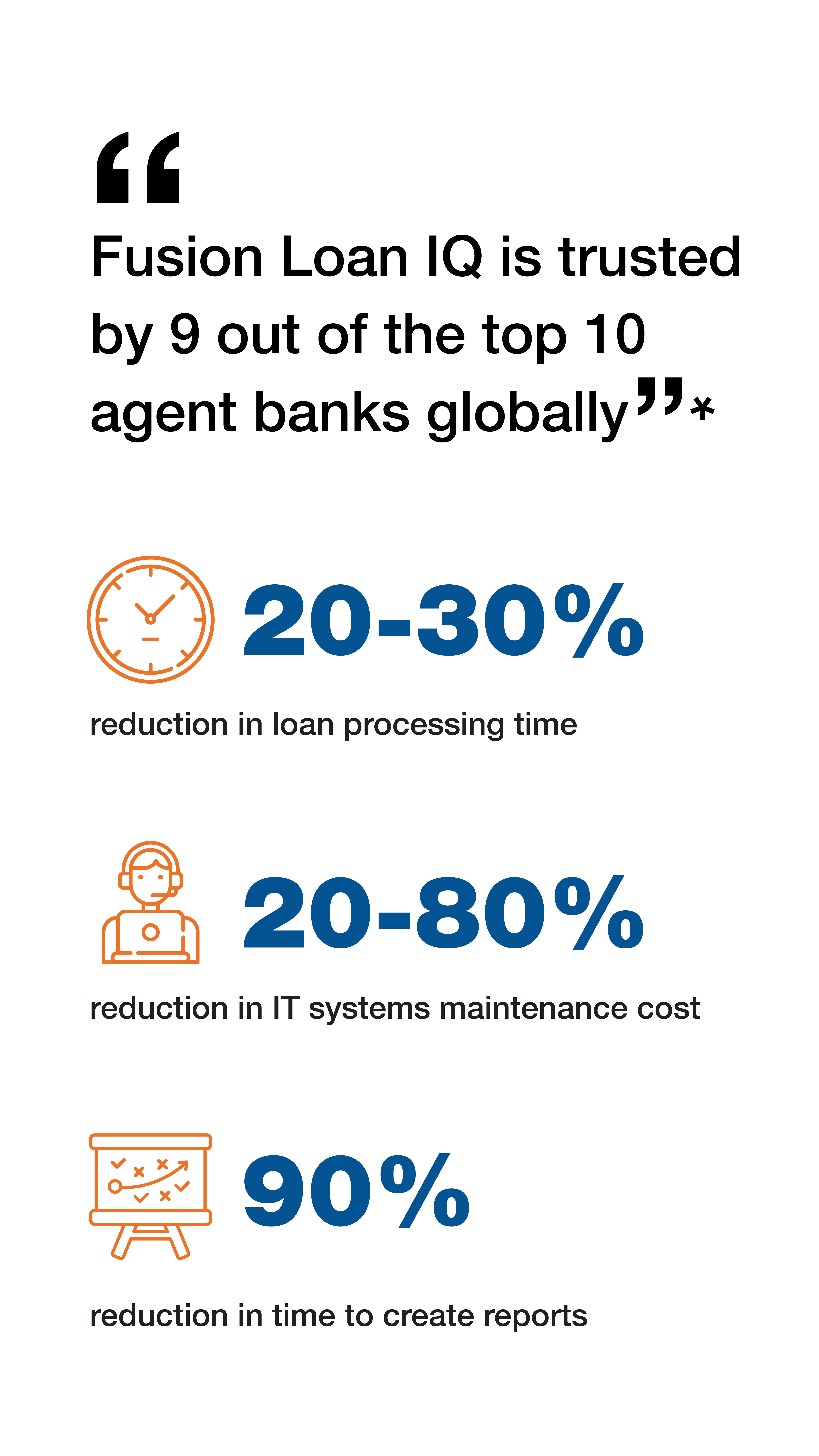

- Fusion Loan IQ is a proven solution developed to meet the needs of the world’s most demanding loan markets.It reflects over thirty-five years of collaboration with top industry participants to bring best practice methods to all aspects of lending.

- By accessing a single commercial lending platform that builds scale and reduces integration costs across business lines.

- 30% Reduction in IT support

- 50% Reduction in integration costs

- 20-80% Reduction in IT systems maintenance cost

- Loan IQ develops a central source of integrated high- quality data for sound decision-making, credit risk management and regulatory reporting, including Foreign Account Tax Compliance Act (FATCA)

- 20% Reduction in loan defaults

- 90% Reductions in time to create reports

You cannot copy content of this page